03102018 The capitalization rate often just called the cap rate is the ratio of Net Operating Income NOI to property asset value. There is one fundamentally important rule when it comes to cap rates.

How To Pick Your Real Estate Investment Niche Real Estate Info Guide Real Estate Investing Investing Real Estate Tips

04052017 If so you will need to learn the terms of real estate and one of the most important terms you need to understand is CAP rate which stands for Capitalization Rate.

What is cap rate mean. It serves the same purpose as an earnings multiplier does for stock investors. A risk-free rate of return is the rate of return on an investment that has no risk of incurring any financial loss. The capital rate is a great tool to use to help you profit more from your rental property.

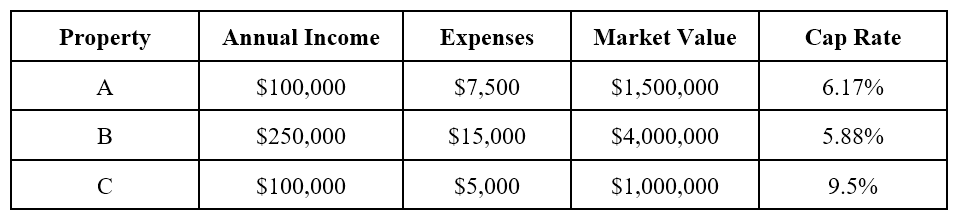

Capitalization rate or cap rate is a real estate valuation measure used to compare different real estate investments. A capped rate adjusts based on a benchmark interest rate below the limits of the cap. So for example if a property recently sold for 1000000 and had an NOI of 100000 then the cap rate would be 1000001000000 or 10.

While cap rate does not consider the impact of mortgage financing a general rule of thumb is whether the cap rate is above or below the interest rate. A cap rate is composed of a risk-free rate of return and risk premium. The ratio of priceearnings often called a PE ratio allows investors to compare one company to the next.

Capitalization rate also known as cap rate is the rate of return on a real estate investment. 16072018 Capitalization rate or Cap Rate for short is commonly used in real estate and refers to the rate of return on a property based on the net operating income NOI that the property generates. Cap rate Net operating income Current market value Sales price of the asset.

The cap rate formula is cap rate net operating incomecurrent property value. If the cap rate is greater than the interest rate youll generally come out ahead. Many newbie real estate.

Treasury bonds interest rate which is considered financially safe. A good cap rate is typically higher than 4 percent. Cap rate is the most popular measure through which real estate investments are assessed for their profitability and return potential.

Although there are many variations a cap rate is often calculated as the ratio between the net operating income produced by an asset and current market value. Capitalization rate commonly known as cap rate is a rate that helps in evaluating a real estate investment. The cap rate simply represents the yield of.

A capped rate is an interest rate on a loan that has a maximum limit on the rate built into the loan. 09082020 The cap rate or capitalization rate is a term used by real estate investors to measure the expected rate of return on an investment property for sale. That means that y ou cannot include debt in a cap rate calculation.

Normally the risk-free rate is derived from the US. Not surprisingly cap rates have proven instrumental in building some of todays most prolific real estate investment portfolios and theres no reason it couldnt help you do the same. Definition of Capitalization Rate.

Its the most commonly used metric by which real estate investments are evaluated. The cap rate only refers to unlevered numbers. This purchase price also includes any expenses that are for upfront repairs.

04062021 A cap rate otherwise known as a capitalization rate is one of the most important fundamental indicators for determining whether a property is worth pursuing. So when you look at a 10 million dollar building and its throwing off a half million in income every year its giving 5 interest. Cap rate is a measure that makes it possible to compare properties even though they produce different levels of operating earnings.

Example of Risk Premium in a Cap Rate. 13072016 Cap rate or capitalization rate is the ratio of a propertys net income to its purchase price. 27082018 A capitalization rate or cap rate is used by real estate investors to evaluate an investment property and show its potential rate of return helping decide if they should purchase the property.

23072018 A good way to analyze rental property is called a cap rate. The formula for a cap rate is the net operating income divided by the purchase price. Its an essential number for gauging a propertys rental income potential.

In other words capitalization rate is a return metric that is used to determine the potential return on investment or payback of capital.

Global Co2 Emissions Since 1980 Solid Black And Country Pledges Under The Paris Agreement Dashed Compared To A Hig Paris Agreement Emissions Climate Change

Capitalization Rate Overview Example How To Calculate Cap Rate

What Is Co Broking And How Do Real Estate Agents Co Broke Hauseit Real Estate Real Estate Agent Estates

How Much Money Can You Make Rental Income Real Estate Investing Investing Real Estate Investing Real Estate Investor

What Is A Bungalow Rental Property Investment Real Estate Buying Real Estate Terms

Rate Of Change Analysis Says Buy Theo Trade Analysis Sayings Stock Market

Capitalization Rate Overview Example How To Calculate Cap Rate

Legalbeagles Info The Borrowers Payday Loans How To Apply

I Often Get Asked What Will I Do With Money When I Am 60 Investing 101 Investing Stock Market

0 komentar:

Post a Comment